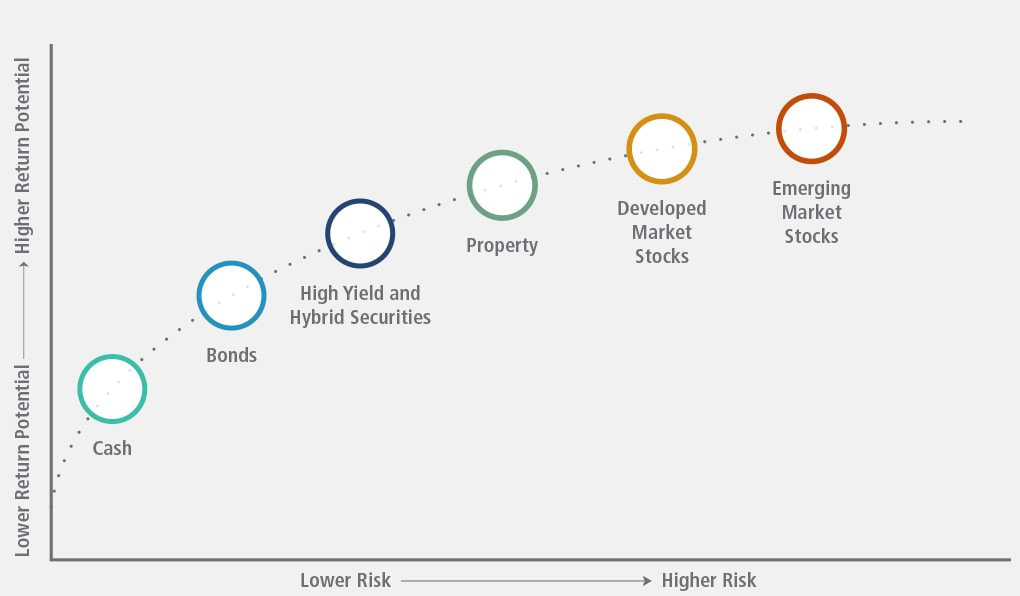

The Traditional Risk Versus Return Concept

Shares are traditionally the riskiest asset class, however, they also tend to provide the biggest reward if investors are prepared to ride out the short-term fluctuations. At the other end of the spectrum, cash is a relatively low risk investment, however, the earnings potential reflects the relatively low risk.

Source: PIMCO

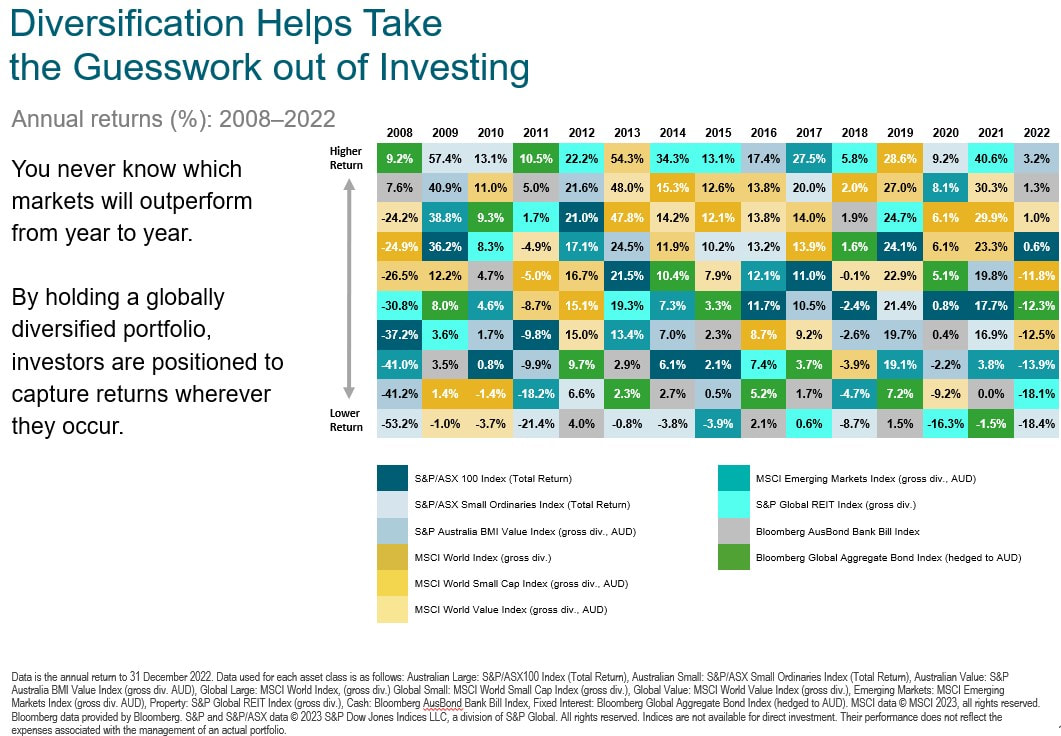

Asset Class Performance

This chart illustrates how the worst performing asset class can quickly become the next year’s best performing asset class. Don’t underestimate the opportunity cost of remaining heavily invested in a more conservative asset class. Whilst cash offers consistent returns, you may be missing out on much greater returns offered by other asset classes.

Source: Dimensional Funds Australia

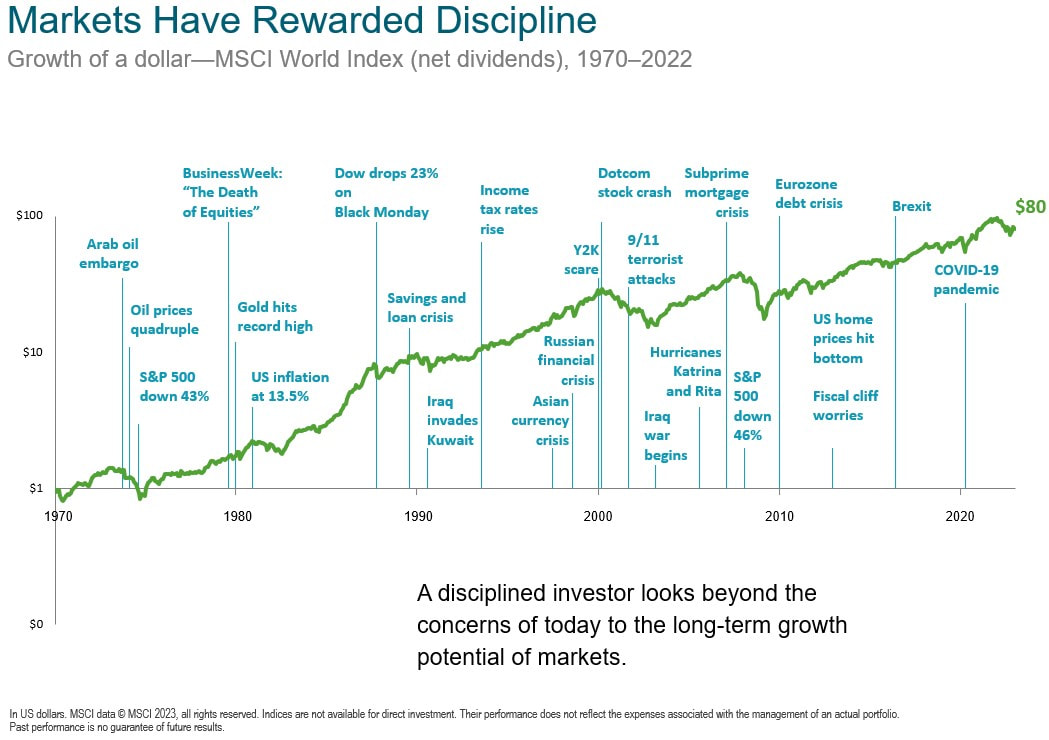

Long Term Performance

Remember to consider your long-term investment plan and not focus on the short-term volatility associated with investment markets.

Source: Dimensional Funds Australia

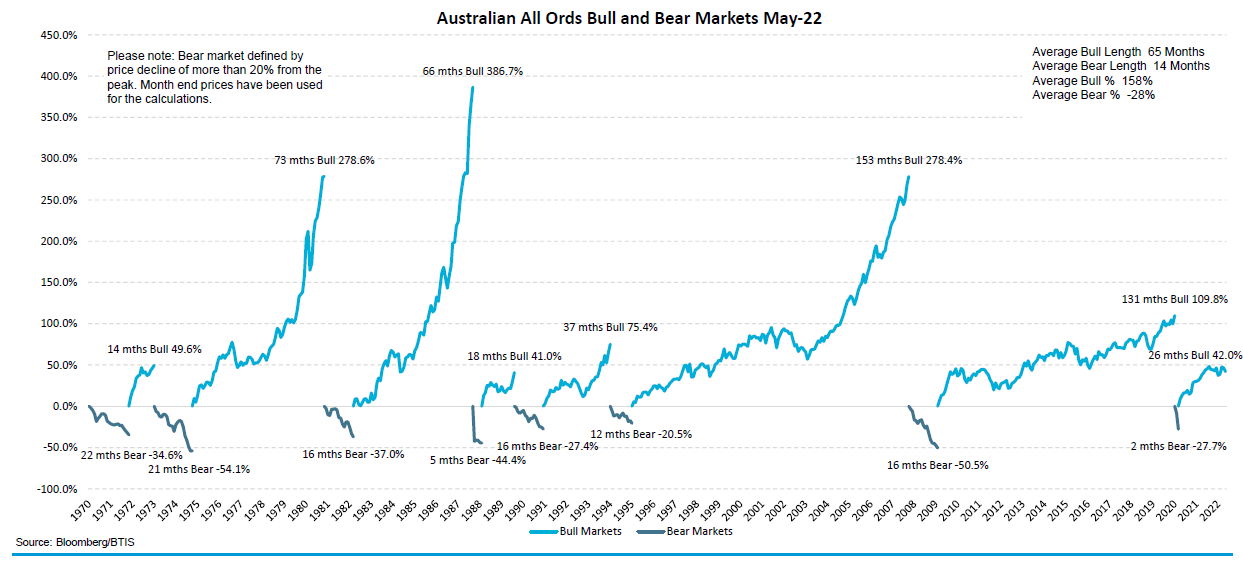

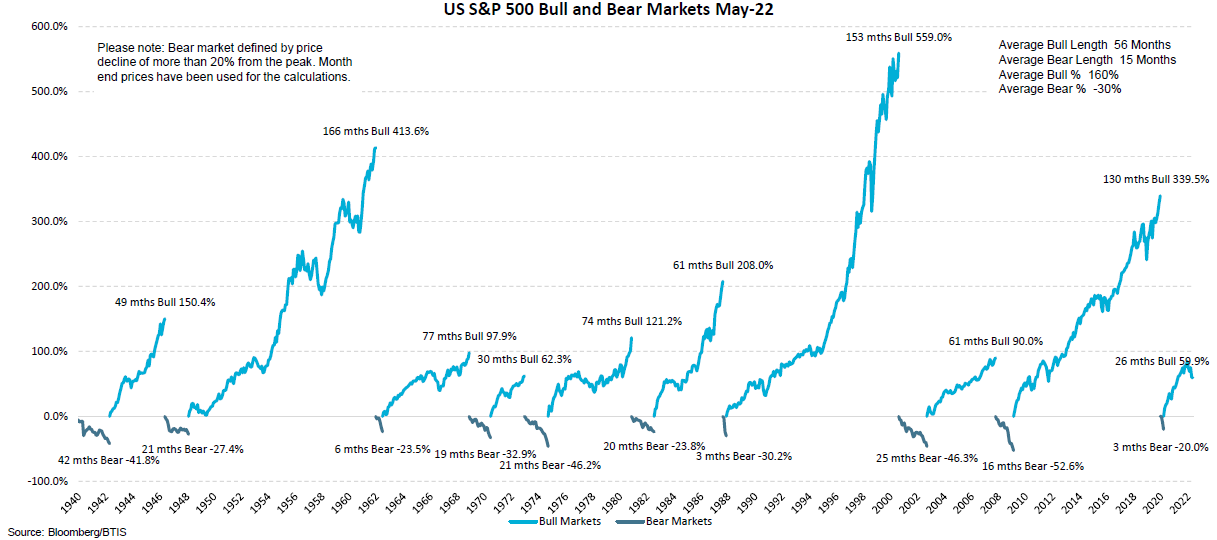

Don't Panic When Market's Fall

These charts illustrate the performance of the Australian All Ordinaries US S&P 500 Indexes during and following a major crisis. As you can see, the rewards for those investors who bought more quality shares after a market fall were substantial. Fortune usually favours the brave!

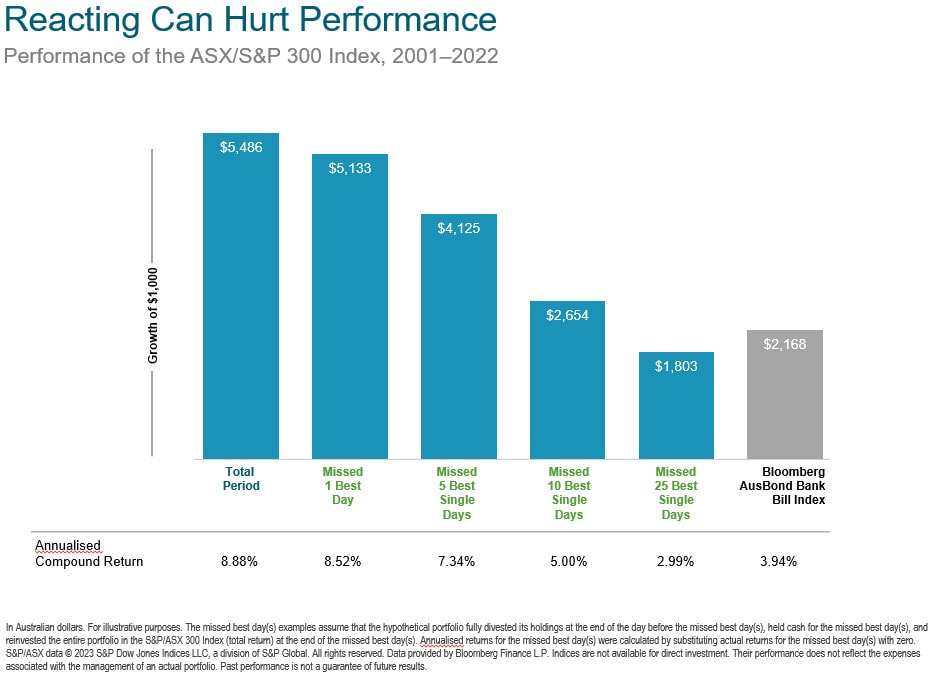

Focus on Your Long Term Strategy

Reacting can hurt performance. In fact, it can be a sure-fire way to wealth destruction.

Source: Dimensional Funds Australia

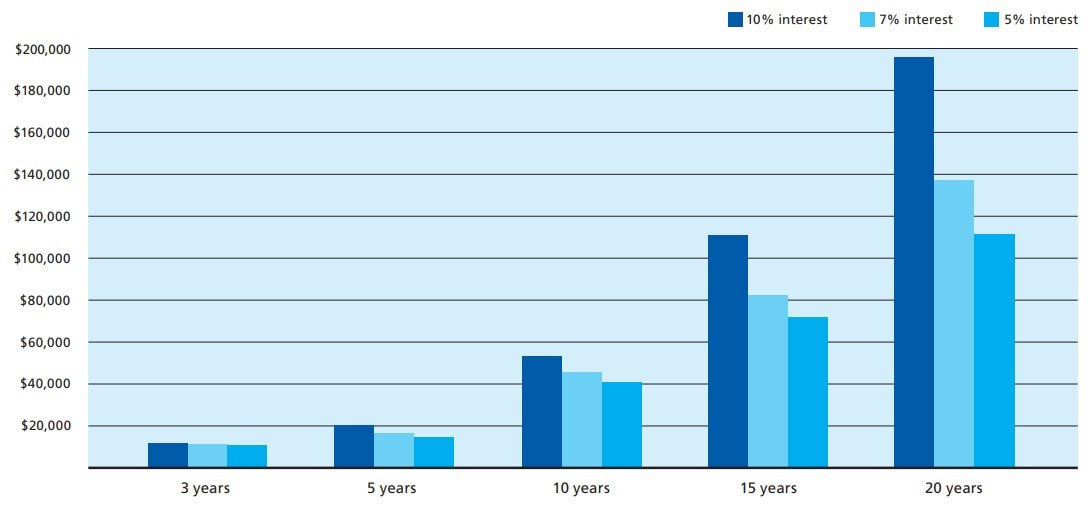

The Power of Compound Interest

This chart illustrates the cumulative effect of investing $1000 today and $250 per month over the stated time periods at different interest rates. If you start investing today, your total investment pool has the ability to grow stronger and benefit from the power of compounding.

Source: Zurich

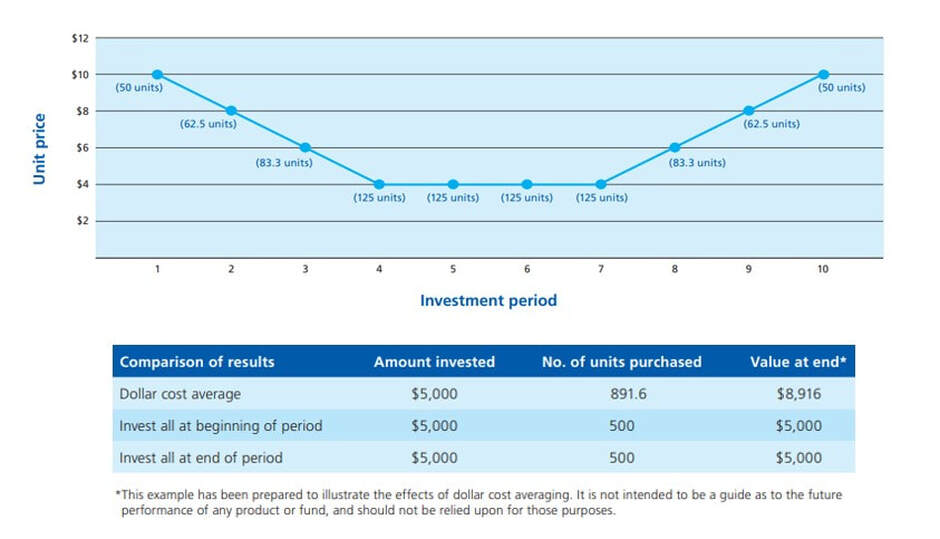

Profit from Dollar Cost Averaging

Let’s assume an investment of $500 at each period in a savings plan. When the unit price falls, $500 buys more units which enables investors to buy cheaply during a falling market.

Source: Zurich

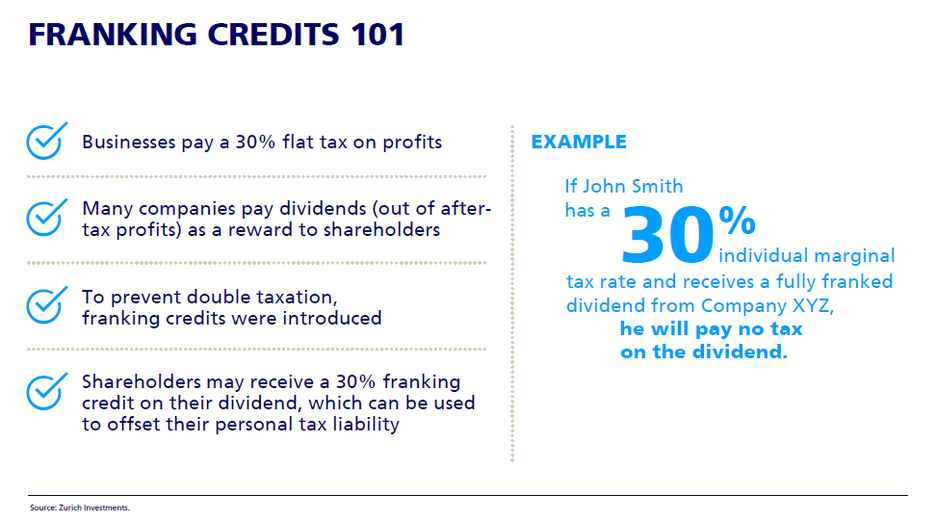

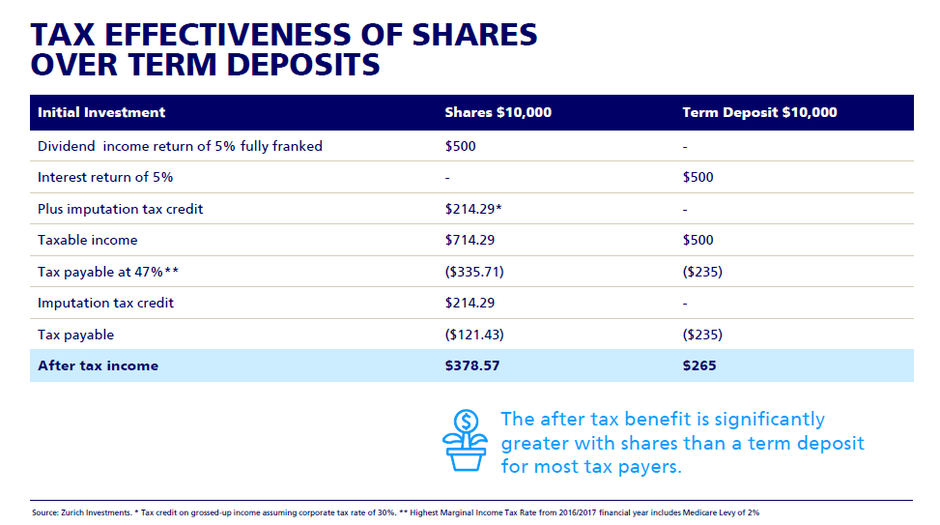

The Tax Effectiveness of Australian Shares

Australian shares provide tax benefits that increase your returns. Discover how dividend imputation can show you the true value of your Australian Share Investments.

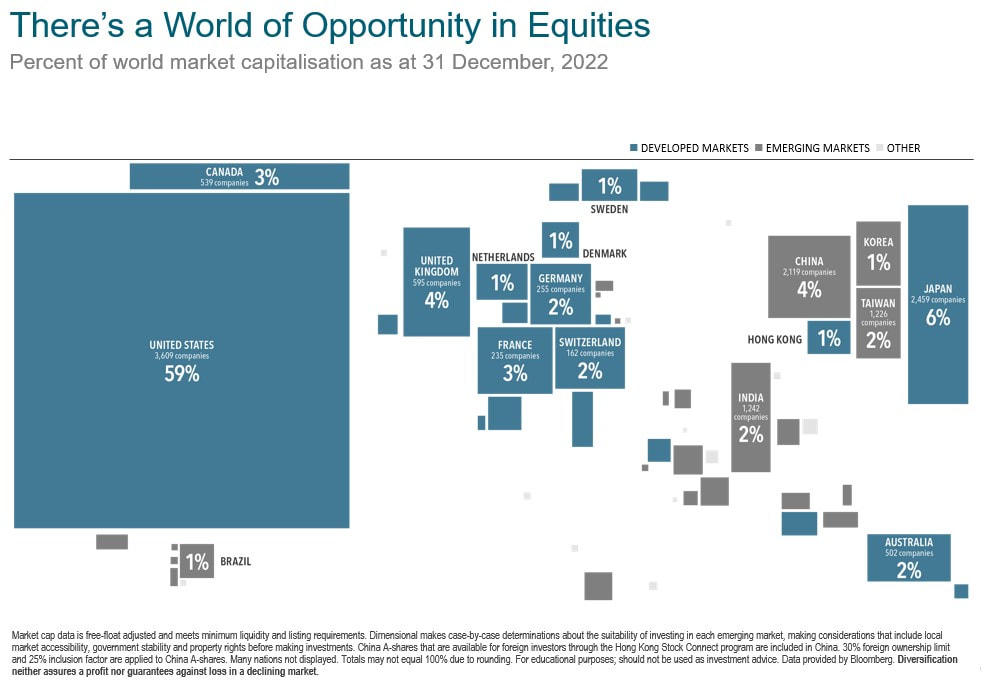

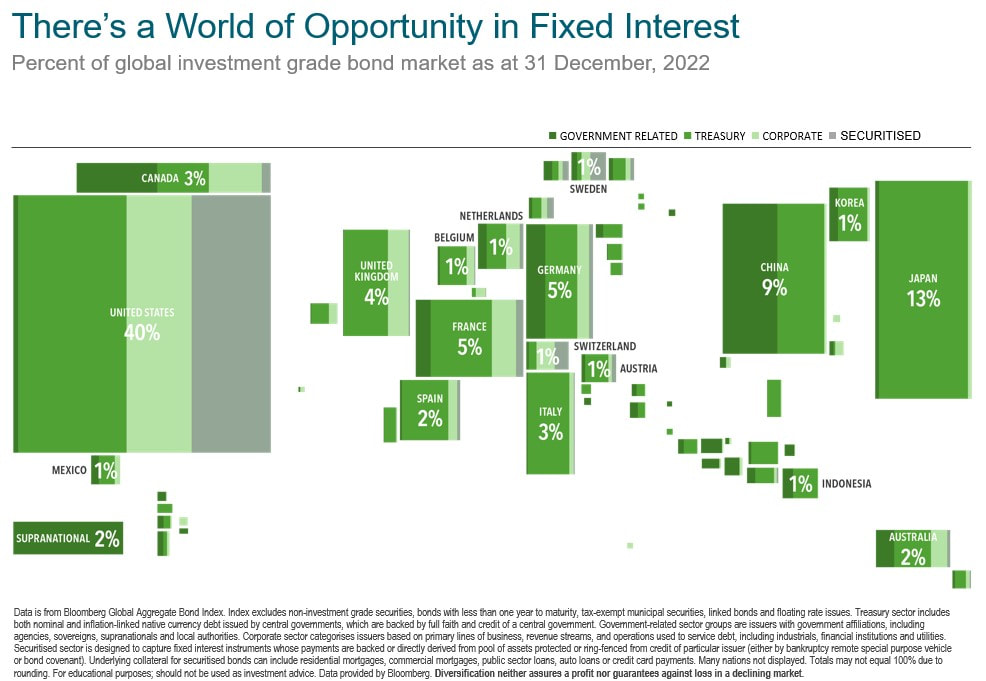

Global Diversification

Investing globally enables investors to increase portfolio diversification.

Source: Dimensional Funds Australia